Foreign Exchange - Currency Outlook

This morning we get US data that is sure to be a US Dollar negative, if the market chooses to heed it. Reuters reports that US housing starts probably fell to an annual rate of 450,000 units in Feb, another record low, after a drop of almost 40% in the previous three months. January's rate was 466,000, the lowest since the Commerce Department began keeping records in 1959.

This means speculative building has come to a screeching halt.

That's a good thing, isn't it?

It allows unsold inventory to get cleared. Reuters also reports that "Permits for future groundbreaking, which give a clue to construction plans, also are projected at a record low unit rate of 500,000 in February, down from January's pace of 531,000, which also was the lowest on record. Tight credit standards have made it more difficult for potential home buyers to get financing. And builders have cut activity sharply in an effort to whittle down a big glut of unsold homes.”"

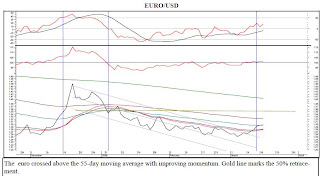

The focus this weeks seems not to be on the US economy, though. Instead, the focus is on the euro exchange rate and the viability of the eurozone. Yesterday Trichet had on his cheerleaders' costume, telling an audience in Berlin that the euro rate is a "unique and irreplaceable anchor of stability and trust" and "Europe can rely on us to preserve that anchor." Also ,the ECB will "play as active a role as possible in the international financial institutions and international informal groups to which we belong." The ECB "always supports a multilateral approach." German Chancellor Merkel also said we need a strong euro exchange rate in the current crisis.

Does this mean European officials are willing to accept a too-strong euro at the expense of exporters to make their point that the euro rate can withstand a giant recession (the Friedman test)?

Yes, it would seem so.

Is it working?

Not really, if we consider the 8:30 move to near 1.2900. We expected a pullback but not to this extent. Now the euro rally is up for discussion. Many foreign exchange analysts had kept their forecast of a strong us dollar on either the safe-haven story of the FIFO story, so they will be vindicated if the move continues. We feel that all the stories are weak, especially the connection between equities and currencies. A prudent course might be to retreat to the sidelines as the euro bulls and bears slug it out.

Pounds to US Dollars = 1.4020

Pounds to Euros = 1.0798

Euro to Pounds = 0.8257

Pounds to Australian Dollars = 2.1207

Bye For Now

Barbara Rockefeller

Foreign Exchange Trading

Forex Trading Reports - Click for a free trial

Buying Euros? Buy Euros at the best euro Rates!

Buying Dollars? Buy US Dollars at the Best Dollar Rates!

Buying Australian Dollars? Buy Australian Dollars at the Best Australian Dollar Rates!

Contact IMS Foreign Exchange + 44 207 183 2790

No comments:

Post a Comment